How ease would you be at if you walk into a bank where your every need is predicted before you even state it—that’s the power AI. From personalized banking advice to real-time fraud detection, Artificial intelligence in banking is at the forefront of creating a smarter, faster, and more secure financial world. For instance, AI-driven chatbots now handle everything from basic customer inquiries to complex loan mobile applications, providing responses in seconds rather than the minutes or even hours it might take a human. Moreover, these bots learn from each interaction, constantly improving their responses and making your banking experience smoother each time.

Beyond customer service, AI technologies are making significant strides in how financial data is managed and utilized. Machine learning models are capable of analyzing vast amounts of transaction data to identify patterns that might indicate fraudulent activity, thus enhancing security measures. For example, AI systems in banks can now detect unusual transactions in real-time, alerting both the bank and the customer immediately to prevent potential fraud. Additionally, predictive analytics are used to assess credit risk more accurately, allowing banks to offer more personalized lending rates based on individual risk profiles, rather than a one-size-fits-all approach.

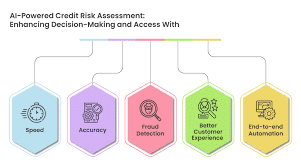

AI in Risk Assessment

Source: https://www.kiya.ai/unlocking-the-power-of-ai-in-credit-risk-assessment/

Have you ever thought about how banks determine who is eligible for a loan? It’s no longer just a matter of looking at your income statements or checking your savings account. Artificial intelligence in banking is changing the way banks assess your ability to repay loans, ensuring decisions are faster, fairer, and more reflective of your current financial situation.

How AI Analyzes Financial Behavior:

- Deep Data Dive: AI technologies, especially machine learning, analyze vast amounts of data from your financial history. This isn’t limited to your previous loans or credit card payments but extends to examining your purchasing habits, bill payments, and overall financial management.

- Predictive Capabilities: By processing this comprehensive data, AI predicts your future financial behavior. This helps banks assess the risk involved in lending to you more accurately than traditional methods.

Real-World Example of AI in Credit Scoring:

- Dynamic Credit Scoring: Banks like JPMorgan Chase utilize machine learning to continuously update their credit scoring models. This method adapts to new financial data, making the credit scoring process more dynamic and precise.

- Outcome: These enhanced models help in accurately determining who gets a loan and under what conditions, reducing the risk of defaults and enabling fairer lending practices.

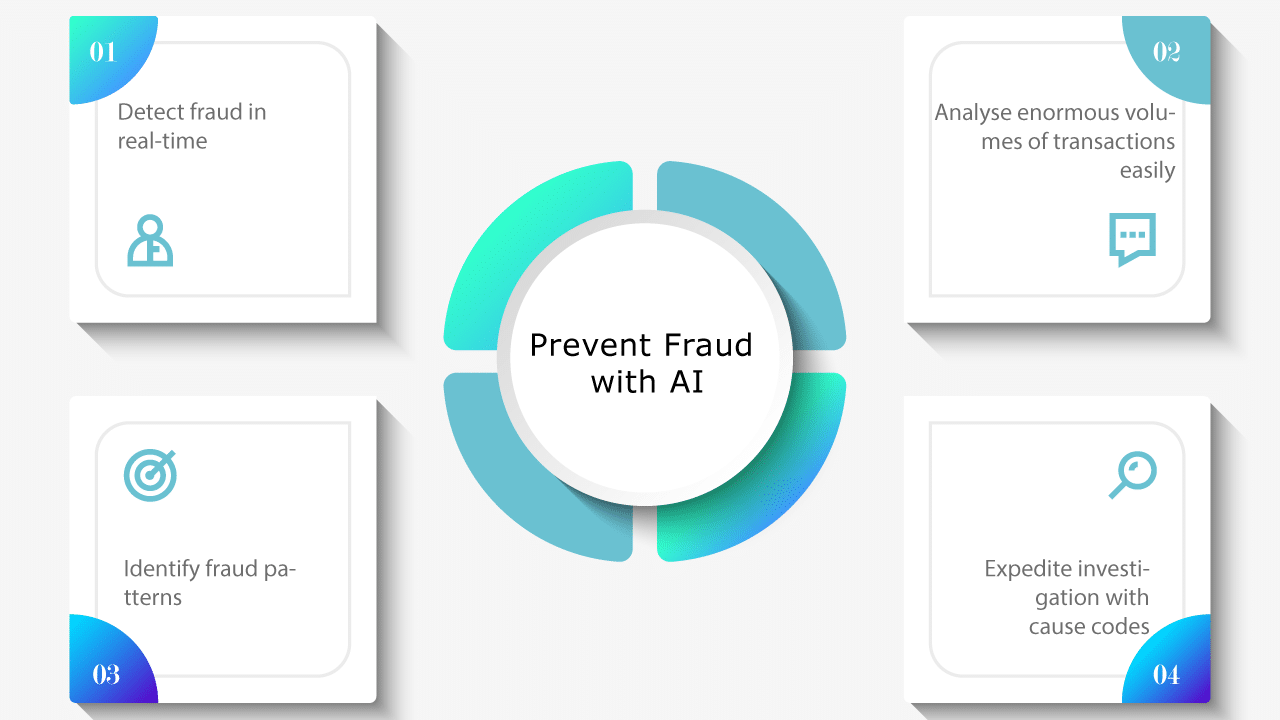

AI in Fraud Detection and Prevention

Source: https://www.linkedin.com/pulse/can-ai-turnaround-fraud-detection-suman-kumar-singh/

Imagine having a highly trained guard who never sleeps, watching over every transaction in your bank account. That’s pretty much what AI does in the world of banking today. Artificial intelligence in banking are incredibly good at spotting things that don’t look right, like unusual transactions that could be fraud. This is changing the game in fraud detection and prevention, making it faster and more reliable than ever before.

How AI Detects Fraud:

- Pattern Recognition: AI systems learn from millions of transactions. They know how normal spending patterns look and can spot odd ones that might suggest fraud.

- Anomaly Detection: The AI is on the lookout for anything out of the ordinary. This could be a sudden large purchase far from where you live or multiple transactions in a very short time.

AI Use Case in Banking: Citibank

- Challenge: With millions of global transactions, Citibank needed a way to pinpoint fraudulent activities quickly to protect their customers.

- Solution: The bank implemented complex AI systems designed to analyze transaction patterns in real time.

- Results: The AI system identifies anomalies and flags them for review. It reduces false positives, meaning fewer legitimate transactions are incorrectly flagged as fraudulent, and improves the detection of actual fraud, thus protecting customer assets more effectively.

- Impact: Citibank reported a significant reduction in fraud losses, thanks to the early detection capabilities of their AI systems.

AI in Personalized Banking

Source: https://www.pragmaticcoders.com/blog/personalized-banking

Ever wished you had a personal banker who understands exactly what you need, anytime you need it? AI-driven technologies like chatbots and virtual assistants are turning everyday banking into a personalized experience, catering to your unique financial needs with precision and ease.

What AI Brings to Your Banking Experience:

- 24/7 Availability: AI doesn’t sleep. Whether you need to check your balance at midnight or apply for a loan on a holiday, AI banking applications are there to help.

- Personalized Advice: Based on your spending habits and account history, AI can offer tailored advice. Thinking about buying a new home or investing in stocks? AI can analyze your financial health and guide you on the best paths to take.

Example: AI-Powered Financial Advisors

- Custom Investment Tips: AI financial advisors like those used by firms such as Betterment or Wealthfront gather data on your financial behavior, goals, and risk tolerance. They use this information to suggest investments that suit your personal preferences and financial objectives.

- Automated Portfolio Management: These advisors aren’t just for advice; they actively manage your investment portfolio, adjusting it based on market changes and your evolving financial situation.

Detailed Breakdown:

- Data Analysis: AI tools continually analyze vast amounts of market data along with your personal financial data to provide real-time, customized advice.

- Proactive Support: If an AI system notices you regularly incur overdraft fees, it might suggest budgeting tools or different account options to help save money.

AI in Algorithmic Trading

Source: https://www.acuitykp.com/blog/ai-algorithmic-trading/

Have you ever wondered how it’s possible to make money from the stock market in what feels like the blink of an eye? It’s all because of AI-powered algorithmic trading, which helps traders make lightning-fast decisions that are smarter and more precise.

What is Algorithmic Trading with AI?

Algorithmic trading uses computer programs (algorithms) that follow a defined set of instructions to place trades. The goal is to generate profits at a speed and frequency that is impossible for a human trader. Here’s how AI turbocharges this process:

- Data Analysis: AI algorithms can analyze massive volumes of market data—looking at stock prices, news stories, economic indicators, and more—all to make predictions about where those stocks are headed next.

- Decision Making: Based on this data, AI quickly decides when, how much, and what to buy or sell. These decisions are made in milliseconds, much faster than any human could manage.

Examples and Insights:

High-Frequency Trading (HFT): This is a type of algorithmic trading that uses powerful AI systems. Firms that engage in HFT might execute hundreds of thousands of trades in a single day. For instance, major financial firms like Goldman Sachs and JPMorgan Chase use AI not just to execute trades but also to manage the risks associated with such high-speed trading.

- Performance: AI algorithms can drastically improve the accuracy and profitability of trades. For example, it’s reported that HFT firms significantly outperform traditional trading methods, often capturing very small price differences in stocks that add up to substantial profits.

AI in Customer Data Management

Today, businesses use AI to sift through mountains of data about their customers, helping them to deliver not just good, but great customer service. Here’s a closer look at how AI is transforming the way companies manage and use customer data to really turn up the dial on customer satisfaction.

How AI Enhances Customer Data Management:

- Understanding Customer Behaviors: AI algorithms analyze how customers interact with services and products online. From what you click on to how long you spend looking at a certain item, AI is taking notes. This helps companies understand what grabs your attention and what doesn’t.

- Improving Service Delivery: With insights gained from AI, companies can customize their communications and services to match your preferences. This means less time sifting through things you don’t care about and more time enjoying tailored content and offers.

The Impact:

- Companies that use AI to manage customer data see a significant increase in customer satisfaction because they can provide highly relevant and personalized experiences.

- Statistics show that businesses using AI in accounting can see a boost in profits by up to 45% because of more effective targeting and personalization.

Benefits of AI in Finance and Banking

Source: https://towardsaws.com/ai-in-finance-5-benefits-for-better-banking-70cbaae31911

AI in finance and banking is making this a reality, enhancing everything from your daily interactions with your bank to the big financial decisions companies make. Let’s dive into how AI is not only making banking easier but also smarter and more efficient.

1. Enhanced Customer Experience

- 24/7 Availability: AI doesn’t sleep, which means you can access banking services anytime, anywhere. Whether you’re checking your balance at midnight or transferring money on a holiday, AI-powered services are always on.

- Personalized Communication: Just like your favorite streaming services suggest shows you might like, AI analyzes your banking habits to provide personalized advice and offers. This could mean suggesting a savings plan based on your spending patterns or alerting you to a new investment opportunity that fits your profile.

- Impact: This level of service leads to happier customers. Banks that use AI report higher customer satisfaction and loyalty, as people appreciate a service that understands their needs and is always there when they need it.

2. Improved Operational Efficiency

- Automation of Routine Tasks: AI excels at taking over routine tasks such as data entry, transaction processing, and even complex regulatory compliance checks. These tasks can consume a lot of time when done manually.

- Faster Service: With AI handling these tasks, services become much faster. Loan approvals that used to take days or weeks can now be completed in minutes.

- Impact: The automation not only speeds up processes but also cuts costs and reduces the chances of human error. This efficiency is a major plus for both customers looking for quick service and banks aiming to reduce operational costs.

3.Greater Accuracy and Decision Making

- Data Processing: AI can process vast amounts of information in a fraction of the time it would take humans. This includes analyzing market trends, customer data, and economic indicators to make informed decisions.

- Real-time Insights: AI’s ability to provide real-time insights helps banks and financial institutions make better decisions quickly. For example, AI systems can detect a potential drop in the stock market and adjust investment portfolios to mitigate losses.

- Impact: This enhanced decision-making capability means that financial forecasts and investment decisions are more accurate, leading to better financial outcomes for both banks and their customers.

Top Companies Using AI in Finance

1.BBVA (Banco Bilbao Vizcaya Argentaria)

Source: https://www.bbva.com/en/brief-history-bbva-xxiv-banco-de-bilbao-banco-de-vizcaya-merge/

BBVA uses AI to enhance customer interactions and security. They have developed a digital assistant that helps customers manage their finances and offers personalized financial advice. Furthermore, BBVA utilizes AI for risk analysis, fraud detection, and to streamline operations, significantly reducing processing times for customer requests.

This approach has not only improved customer satisfaction by providing a more personalized banking experience but has also increased the efficiency of their operations.

2.OCBC Bank

Source: https://www.whitepageinternational.com/banking/ocbc-bank/

OCBC has been a leader in adopting AI in Southeast Asia, particularly in the area of customer service. They introduced an AI-powered chatbot that handles customer inquiries and transactions, providing responses in real-time.

This AI initiative has drastically reduced the time customers spend on managing their accounts and has helped OCBC cut down on operational costs while improving service accuracy.

3.Kasikornbank

Source: http://thaichamvn.org/new-corporate-member/kasikornbank-public-company-limited/

Kasikornbank has integrated AI across various aspects of its operations, from fraud detection systems that monitor for unusual activity to chatbots that assist customers with their banking needs. They are also exploring AI to help with loan underwriting, aiming to speed up the process while maintaining accuracy.

Their innovative use of AI in finance has allowed Kasikornbank to offer faster, more reliable banking services and has positioned them as a leader in tech-driven financial services in Thailand.

4.Atom Bank

Source: https://www.linkedin.com/pulse/atom-bank-raises-30m-funding-startuplanes/

Atom Bank, known as the UK’s first app-based bank, uses AI to tailor banking experiences to individual needs. Their app includes features that predict and analyze customer behavior to offer customized saving advice and loan options.

By leveraging AI, Atom Bank provides a highly personalized banking experience that appeals to tech-savvy customers, enhancing customer loyalty and engagement.

5.Ally Bank

Ally Bank uses AI to enhance both customer-facing and back-office operations. Their AI-powered tools help customers make better financial decisions by analyzing personal spending patterns and suggesting ways to save money.

Ally’s use of AI has not only improved customer satisfaction rates but has also positioned them as a forward-thinking financial institution in the competitive U.S. market.

Future of AI in Finance and Banking

Source: https://www.app0.io/blog/ai-in-finance

As we look into the future, AI is not just enhancing financial services; it’s reshaping them from the ground up. Here’s how emerging trends, challenges, and strategic implementations of AI are set to revolutionize the industry.

1. Growing Trends in AI Technologies

As technology advances, so does the potential of AI in finance. One of the most exciting software developments is the advent of quantum computing, which promises to take data processing and security to an entirely new level. Quantum computers can process complex problems much faster than current systems, potentially reducing risks and enhancing trading strategies.

Consider the impact on fraud detection. Quantum computing could analyze vast datasets almost instantaneously, spotting fraudulent activities before they cause significant damage.

2. Challenges and Ethical Considerations

With great power comes great responsibility. AI’s ability to analyze and store immense amounts of personal data raises significant privacy concerns. Additionally, as AI systems become more capable, the displacement of jobs is a real risk, particularly for roles focused on routine tasks.

Financial institutions are increasingly aware of these challenges. Many are implementing stricter data protection measures and ethical guidelines for AI use. Additionally, they are investing in retraining programs, helping employees transition to more strategic roles that require human oversight.

3. Strategic Importance of AI Integration

For banks and financial firms, staying competitive means staying ahead of the technology curve. AI integration is no longer a luxury but a necessity. It allows for smarter, faster decision-making, tailored customer experiences, and more robust security measures.

Looking ahead, banks plan to expand their use of AI in almost every area of operation. From automated customer service systems to AI-driven investment advice and risk management, the goal is to make every process more efficient, secure, and customer-friendly.

Conclusion

AI has not only streamlined operations by automating mundane tasks but has also enhanced customer experiences with personalized services that anticipate needs and offer AI banking solutions in real-time. The advantages extend into risk management and compliance, where AI’s predictive capabilities help safeguard against fraud and ensure regulatory adherence. With such significant benefits, it’s no wonder that AI is often hailed as the next big revolution in finance.

However, despite these advancements, not all banks have embraced AI technology. Experts suggest that reasons range from the high costs of implementation to concerns over data security and customer privacy. There’s also a significant learning curve and cultural resistance to adopting new technologies, especially in institutions rooted in traditional ways of doing business. As AI continues to evolve, the finance sector stands at a crossroads: Will the promise of enhanced efficiency and customer satisfaction be enough to overcome these hurdles?

SHARE THIS POST